The International Fuel Tax Agreement (IFTA) is a program to collect and distribute fuel tax revenue between states and provinces based upon where the fuel was used. IFTA benefits carriers by consolidating reporting requirements through the carriers home state.

States are required to audit Fuel/Mileage Tax reports and records to verify that the correct taxes were paid.

With the Electronic Logging Device (ELD Mandate) in full swing, IFTA auditors are noticing a big issue - carriers are trying to use their electronic ELD data to report their IFTA data but do not have the procedures in place to ensure it is done correctly! Worse yet, the records required for audit are not adequate or sufficient. Instead of using technology to simplify and be more efficient in IFTA compliance, gaps in data, lack of internal controls, lack records and lack of regulatory knowledge are bringing about substantial fines and penalties.

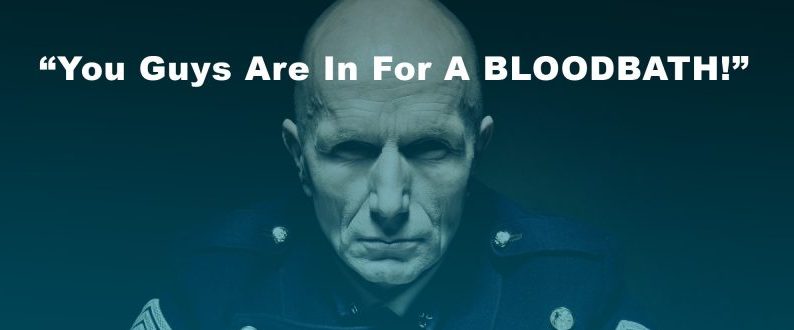

According to one State auditor manager, "you guys are in for a bloodbath!" when speaking about the audit results he is already seeing from carriers relying too heavily on the accuracy of an ELD for their IFTA/IRP compliance data.

When called for an audit, we can assist you prepare and provide guidance to minimize any financial impact.

Are you using accurate data and internal controls to be in compliance with IFTA? Are you keeping the required electronic records for audit? If you can’t confidently respond “yes”, you need to find out before you are audited by the State. That’s where we can help!

We can review a client’s in-house tax reporting procedures to assess the degree of compliance and potential risk in meeting the fuel and mileage tax reporting responsibilities.

Fill out the form and one of our great staff will reach out to you shortly.